TILA-RESPA

TILA RESPA Integrated Disclosure, or

more commonly, TRID

On

October 3rd, 2015 the Consumer Financial Protection Bureau or CFPB is

replacing four existing disclosure forms required under federal law into two

new documents the Loan Estimate and the Closing Disclosure. These new forms

will make it easier for the borrower to understand the loan they will be

receiving and they will be better prepared to make more informed financial

decisions. In addition, here are some

new terms that you will need to be familiar with:

Lender = Creditor

Borrower = Consumer

Tolerances = Variances

Closing/Settlement = Consummation (the date the consumer signs the note)

Settlement Agent = Settlement Service Provider

The new disclosures are explained below in more detail.

The new disclosures are explained below in more detail.

Loan Estimate

The Loan Estimate is replacing the Good

Faith Estimate (GFE) and the initial Truth-in-Lending disclosure (initial TIL). These forms have been combined into this new

form, the Loan Estimate.

Buyers

will get a Loan Estimate no

later than the third business day after they submit a loan application.

The

new form is designed to highlight key terms to enable borrowers to shop around

for the best deals and more importantly it is designed to be user-friendly.

The

Creditor or Loan Broker will provide the creditor with the Loan Estimate.

Closing Disclosure

The Closing Disclosure is replacing the

HUD-1 and final Truth-in-Lending disclosure (final TIL and, together with the

initial TIL, the Truth-in-Lending forms).

These forms have been combined into this new form, now called the

Closing Disclosure.

Consumers must get

this form provided to them at least three business days before consummation of

the loan. Consummation is the date that a consumer

becomes contractually obligated to the creditor on the loan (i.e., the day they

sign the note.) If the form is mailed, couriered or emailed, the lender must

allow an extra three business days on top of that. This means that the

closing cannot occur for at least six business days after the lender or

Settlement Service Provider sends out the completed Closing Disclosure.

The

Creditor or Settlement Service provider will provide the creditor with the

Closing Disclosure.

Loan Estimate variances from Closing

Disclosure

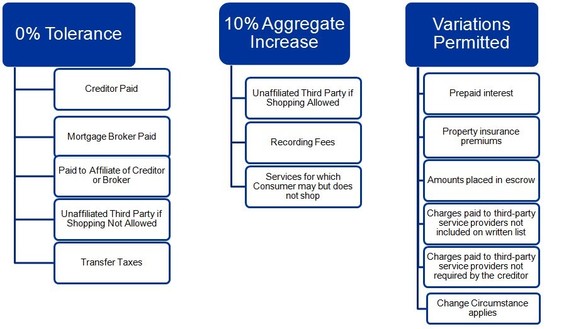

Keep in mind that the Closing Disclosure can change from the Loan Estimate. Variances, formerly known as tolerances, will force more fees into the 0% and 10% categories. Lenders may have greater responsibility imposed on them for the amount their partners charge.

Keep in mind that the Closing Disclosure can change from the Loan Estimate. Variances, formerly known as tolerances, will force more fees into the 0% and 10% categories. Lenders may have greater responsibility imposed on them for the amount their partners charge.

What type of transactions need the

new disclosures?

What type of transactions need the

new disclosures?These

new disclosures and rules apply to residential properties that include a

mortgage as part of a sale or refinance transaction. They do not apply to HELOCs, reverse mortgages

or mortgages secured by a mobile home or by a dwelling that is not attached to

real property (i.e., land), commercial or all-cash transactions.

What is three business day rule?

What is three business day rule?

Every

working day including Saturdays. The exceptions

will be Sundays and legal holidays.

Riva Title Company Is Ready

Riva Title Company Is Ready

Riva Title Company will be ready for the new CFPB changes. We will comply with all CFPB regulations and we will be ready to get the final closing information to the Creditor at least 10 days before the closing date so that the Creditor can complete the Closing Disclosure in time to get it out six days before the scheduled closing.

Location:

5900 SW 73rd Street

Suite 208

South Miami, FL 33143

Phone 786-787-7888

Fax 305-448-4500